A win/win on depreciation

Should depreciation be deducted from a business interruption claim as a “saving”? This Analysis of the issue is from Mark Darwin, a Partner at Herbert Smith Freehills and Peter Rink, Willis Towers Watson Head of Asia Pacific, Forensic Accounting and Complex Claims.

After decades of wrangling, the debate on whether a reduction in depreciation represents a potential saving under a business interruption policy has finally been settled.

A legal precedent has now been set in the case of Mobis Parts Australia v XL Insurance, a division of Axa.

The claim centred on the collapse of Mobis’ warehouse during a storm, damaging stock, plant and equipment.

Both parties agreed that Mobis would have ordinarily made provision in its accounts of $1.5 million for depreciation of plant and equipment destroyed, but it didn’t do so during the indemnity period – because of the damage.

In the original trial, the judge followed a previous precedent ruling that depreciation was an expense “payable” out of gross profit. But Mobis appealed, winning a unanimous verdict from the NSW Court of Appeal.

The judges analysed what they called the “true nature and impact” of depreciation on profit and recognised that the industrial special risks (ISR) business interruption policy, which is common in Australia, does not necessarily indemnify “actual loss” but rather contains a formula for the assessment of insured loss.

They ruled that depreciation is not a charge or expense “payable” out of gross profit according to the formula under an ISR policy, and therefore should not be deducted as a saving, even if this means a qualification to the principle of indemnity.

The arguments for and against including the reduction in depreciation as a saving essentially boil down to whether it is the intention of the policy to restore the policyholder to the accounting net profit position that it would have been in had the damage not occurred, or to maintain the policyholder’s cash position.

That is, should the business interruption insurance policy be indemnifying the policyholder for its cash loss or for its accounting loss from the interruption?

What is not in dispute is that including depreciation as a saving will result in the policyholder being in a worse cash position than it would have been in had the damage not occurred.

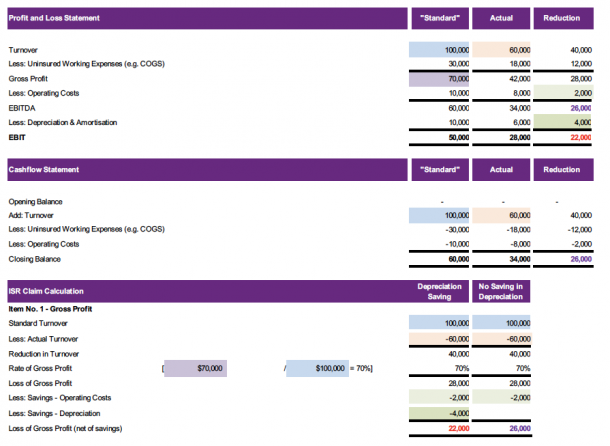

The difference between the cash and accounting perspectives can be seen in the following example loss scenario:

|

In the example above, as a result of the insured damage, the policyholder sustained a reduction in earnings before interest, tax, depreciation and amortisation (EBITDA) of $26,000, and a reduction in earnings before interest and tax (EBIT) of $22,000.

EBIT incorporates a reduction in depreciation of $4000. This is the amount that would be payable to the policyholder if the reduction in depreciation represents a saving. So, the loss depends on which accounting concept you consider.

By contrast, the reduction in turnover from the insured damage has resulted in a reduction in cash flow of $26,000 (the same as the reduction in EBITDA). This is the amount that would be payable to the policyholder if the reduction in the depreciation booked in the accounts does not represent a saving.

If depreciation is deducted as a saving in the calculation of the business interruption claim, we can see that the policyholder would not receive compensation for the additional $4000 of cash that it otherwise would have had available during the indemnity period.

In practical terms, when a business is interrupted, it is cash that is of critical importance to the policyholder. Wages, rent, and other overheads are paid out of cash; not accounting profits.

Our view is that compensation based on the loss of cash flow is the most meaningful to policyholders.

The court of appeal’s decision represents not only a win for policyholders but also for the industry.

Insurers will be able to apply a premium that accurately reflects the risk undertaken, while brokers can provide guidance to clients on the true scope of the business interruption policy cover and the sum insured required.

Policyholders can now pay a premium with confidence that the cash flow shortfall in the event of a claim will be recovered in full.