North Queensland: a competition with no prizes

The Australian Government Actuary’s (AGA) third report on north Queensland insurance pricing contains some basic pointers to how insurance works. Unfortunately, it’s cold comfort to residents who have seen premiums soar and politicians who don't understand insurance.

To the surprise of no one, Actuary Peter Martin finds once again that the region’s premiums have risen because of the losses insurers have incurred on cyclones.

To a lesser degree, lack of competition in the market allows insurers operating there to price without fear of losing market share.

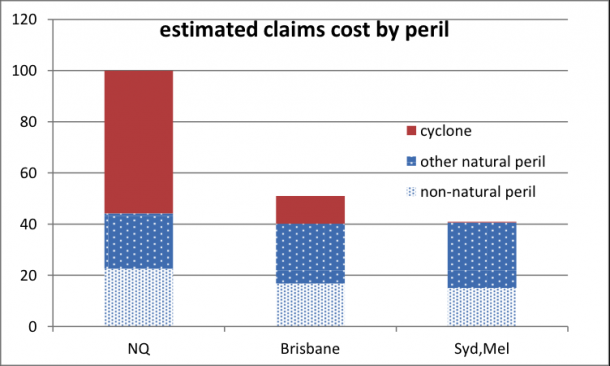

The cost of insuring north Queensland is illustrated in a graph from the AGA report (below), which shows insurer estimates of home building claims costs split by peril.

Source: © Commonwealth of Australia, Australian Government Actuary, 2014

Mr Martin finds cyclone risk can have a substantial regional [his emphasis] impact on premiums, while other natural perils can have a substantial effect on individual policyholders’ premiums, as is the case with flood cover.

Storms are the country’s costliest natural peril for insurers in aggregate dollar terms, but because the risk is more widely spread so is the cost, which means there are no large regional variations in premium rates.

Now that flood is a standard inclusion on many policies, people with little or no risk pay a negligible cost for it, while those at risk can pay very high premiums.

The maximum north Queensland flood risk is estimated to cost 2.5 times the maximum cyclone risk in the region, but because the cost is spread across all policyholders, even for a fairly small region, the cost of flood there is only about 10% of the cost of cyclone risk.

“While some north Queensland policyholders are at greater risk from cyclone than others, most policyholders in the region are at some risk, resulting in a significant regional premium impact due to cyclone,” the report says.

“On the other hand, while some north Queensland policyholders might face extreme flood risk, most policyholders will not have any flood risk.”

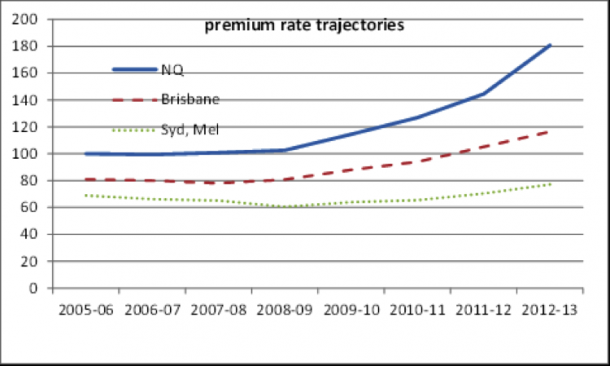

The AGA report features data from Allianz, IAG, QBE, RACQ Insurance and Suncorp for the eight financial years from 2005/06 to 2012/13, and compares premiums and claims with Sydney, Brisbane and Melbourne.

The three cities’ claims costs amounted to only 20% of those in north Queensland, where insurers paid out on cyclones Larry and Yasi and the Mackay storms.

For every $1 they earned in premiums from the north, insurers paid $1.40 in claims.

The period of poor loss experience broadly coincided with developments in catastrophe modelling and a rise in reinsurance costs.

“In my view, it is likely these factors combined to lead insurers to a view that prevailing premium rates in north Queensland were too low when compared with the risk being carried and that rate increases were needed to restore profitability,” Mr Martin says.

Companies varied in the ways they allocated the cost of reinsurance to their north Queensland portfolios, but generally the cost is rising and accounts for 20-40% of the underlying premium.

As insurers’ reacted, premiums grew: in 2012/13 average premiums in Sydney and Melbourne – which have no cyclone risk – were 40% of those paid by north Queenslanders, while Brisbane residents paid 60% of rates in the north.

North Queenslanders’ rates also increased faster than elsewhere, as illustrated below.

Source: © Commonwealth of Australia, Australian Government Actuary, 2014

In a competitive market, insurers might not be able to raise prices to the level they want, but Mr Martin finds competitive pricing pressure is largely missing in the region.

Insurers operating there don’t want to increase market share, so have priced “largely unconstrained by market forces”.

However, the AGA says lack of competition in the market is a “second-order issue” to poor claims experience.

As premiums have jumped in north Queensland, the cumulative loss ratio for insurers has fallen, and Mr Martin notes that relatively benign years in 2011/12 and 2012/13 indicate the region was profitable for insurers in that period.

He calculates that even if the higher premium rates had applied over the eight-year period “an unprofitable loss ratio of close to 100% would have been achieved”, meaning for every $1 of premium, insurers would have paid $1 in claims.

Suncorp Group CEO Patrick Snowball says the insurer would like to see more companies in the market. Allianz, in its response to the AGA report, says north Queensland has a risk problem, not a competition problem, and questions why insurers should be expected to grow their share of a market that is unprofitable at current levels.

Insurance Council of Australia CEO Rob Whelan says action to increase competition in a market where all participants lose money won’t work as effectively as reducing risk.

It was never the AGA’s job to come up with a solution, and the report does not make recommendations.

But it does fill some of the information gaps and it reinforces how much premiums have risen in the north – and why some homeowners can’t afford cover.

The Federal Government’s move to allow unauthorised foreign insurers (UFIs) into the market is unlikely to address the issues, given another cyclone could wipe out insurers’ profits even at current rates.

And questions remain over how UFIs will manage thousands of cyclone claims.

The Government’s solution is therefore no solution, and the AGA report shows there is no easy answer to the high cost of insurance in north Queensland.